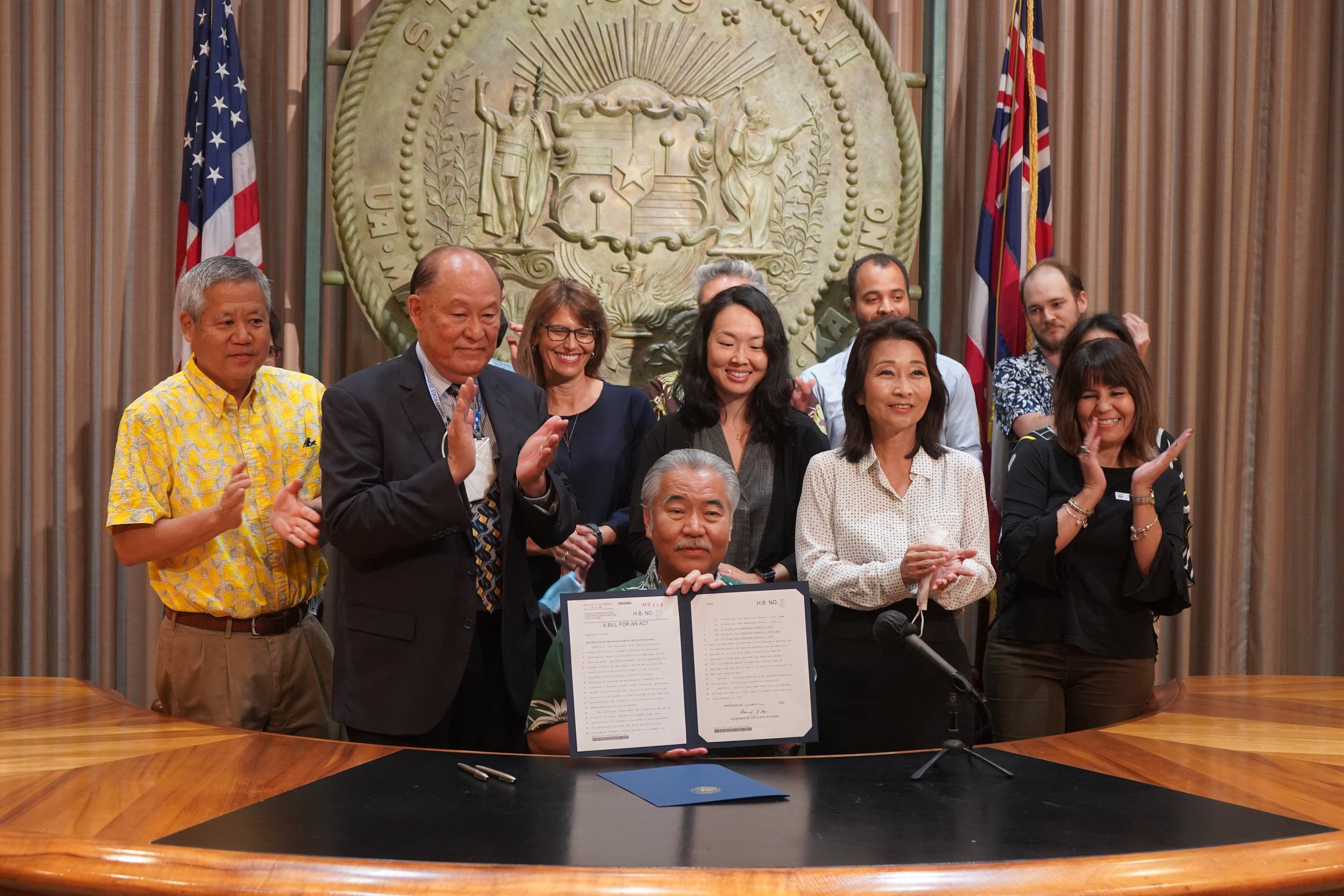

Ige signs minimum wage increase, tax refund bills into law

Gov. David Ige on Wednesday signed a bill to raise Hawaiʻi’s minimum wage for the first time in four years and to make the earned income tax credit permanent and refundable.

He also approved a measure that allows taxpayers making less than $100,000 a year to receive a $300 refund—something made possible by a large budget surplus fueled by a combination of increased tax revenues and federal Covid-19 relief money.

The wage hike was approved by the state House and Senate after they reconciled differences over the amount of the increase, its implementation and what to do with the tip credit for workers such as waiters and valets.

Each chamber aimed to increase the wage to $18 per hour, but the Senate’s version of the bill would’ve done so by 2026 while the House’s version—which ultimately prevailed—specified raising it by 2028. Defenders of the House’s bill cited wanting to ease the financial burden that business owners might face.

Per the bill, minimum wage will rise from its current level of $10.10 an hour to $12 in October and increase every year by $2 starting in 2024 until reaching $18 in 2028.